Corporate Governance

Basic Approach

Ever since its foundation, Kokuyo has always followed a philosophy of enriching the

world through our products. While this philosophy remains central to our

entrepreneurial spirit, we now use the phrase “Be Unique” to express our philosophy

and value-creating ethos in a way that is relevant to today’s challenges, in a world

that is undergoing tumultuous changes. “Be Unique” expresses the idea that we

produce products and services that deliver experience value, stimulating creativity

and celebrating uniqueness.

What has supported our continued growth down the years is the warm trust we have

built up with our shareholders, customers, supply-chain partners, employees,

communities, and other stakeholders. We recognize that these stakeholder

relationships are tangible and intangible assets that constitute the source of our

value as an organization. Safeguarding these assets is a major strategic

priority.

As well as safeguarding stakeholder relationships, we commit to making our

organizational structures and processes efficient, transparent, and fair so that we

remain true to our brand values and sustain long-term value creation.

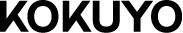

Corporate Governance System

We have a longstanding commitment to separating business execution from management oversight. Back in 2011, we started reserving places on the Board of Directors for independent directors and established the Nominating & Compensation Committee to advise the board about nominations and director compensation. In 2015, we had a CEO succession. Since 2020, an independent director has served as chair of the Board of Directors. We took another important step in enhancing corporate governance in 2024: We transitioned our corporate structure from that of a “company with a board of auditors” to that of a “company with a nominating committee and other committees.” The move took effect when it was approved by shareholders at the 77th Annual General Meeting of Shareholders, held on March 28, 2024. The three designated committees enables better corporate governance.

1. Board of Directors

The Board of Directors has eight members, five of whom are independent directors. One

of these independent directors serves as the board’s chair. All directors serve

one-year renewable terms. This setup helps ensure a dynamic board, capable of

responding swiftly to changing business conditions.

The Board of Directors holds regular monthly meetings, as well as ad-hoc meetings

when necessary.

The board’s role of supervising management is separated from its role of executing

the company’s business. With this separation, the board can both devote sufficient

time to discussing matters of strategic importance (such as making decisions about

the company’s policies and business strategies) and focus on supervising the

management.

2. Nominating Committee

The Nominating Committee has three members. All members are independent directors,

including the chair, who is elected by the members. The committee vets candidates to

be nominated to shareholders for election or re-election to the Board of Directors.

It also vets candidates that the Board of Directors may appoint as shikko-yaku (a

legal title describing an executive who bears fiduciary duties) or shikko-yaku-in (a

non-legal title describing an executive who bears no fiduciary duties; in English,

our shikko-yaku-in are known as “corporate executive officers” or “managing

officers”).

The committee has a total membership of between three and five members, with

independent directors making up the majority of members. As a general rule, the

committee’s chair is elected by the members from among the independent directors.

The committee designates one of its members to give the Board of Directors timely

updates about the committee’s decisions and agenda.

3. Audit Committee

The Audit Committee has three members. Two of the members are independent

directors. The chair is elected by members. The current chair is a non-independent

non-executive director who was also elected by members to be a full-time Audit Committee member.

The committee audits the execution of the company’s business by corporate officers

and directors, prepares audit reports, and decides on proposals for appointing or

dismissing (or not reappointing) the accounting auditor. To ensure that audits are

effective, the members regularly liaise with the heads of Kokuyo’s business units

and corporate divisions and coordinate closely with their counterparts in Kokuyo’s

Internal Audit Division and in key Kokuyo subsidiaries.

The committee has a total membership of between three and five members, with

independent outside directors making up the majority of members. The committee

designates one of its members to give the Board of Directors timely updates about

the committee’s decisions and agenda.

4. Compensation Committee

The Compensation Committee has three members, all of whom are outside directors. The

chair is elected from among the outside directors.

The committee designs the compensation system for directors, corporate officers, and

managing officers, and sets the compensation amounts to be paid to each

recipient.

The committee has a total membership of between three and five members, with

independent outside directors making up the majority of members. As a general rule,

the committee’s chair is elected by the members from among the independent

directors. The committee designates one of its members to give the Board of

Directors timely updates about the committee’s decisions and agenda.

5. Internal Auditing

Internal auditing is undertaken by the Audit Office. The office follows an internal

audit plan, approved by the Audit Committee to evaluate whether the company’s

compliance and control processes are reasonable and working effectively. It reports

the results to the Audit Committee and Representative Corporate Officer. The office

does not report the results of its audits to the Board of Directors directly, but

the Audit Committee may report the results to the board as appropriate.

The office members attend regular meetings with Audit Committee members to report

findings and share opinions on the auding structures and auditing operations, and to

enable close coordination in auditing. The members also hold regular meetings with

departments responsible for internal controls and risk management to share opinions

and coordinate activities. Additionally, they attend regular tripartite audit

meetings to coordinate with the accounting auditor and share opinions as necessary.

6. Compliance with the Corporate Governance Code

See our corporate governance reports to see how we are complying with the items set out in the TSE’s Corporate Governance Code.

7. Criteria for the Independence of Independent Directors

Set out below are Kokuyo’s Criteria for the Independence of Independent Outside Directors.

(1) The Independent Director’s near relatives within the second degree of kinship do not currently serve, or have not served within the past three years, as a Director, Corporate Officer or Auditor of the Company or a subsidiary of the Company.

(2) If the company where the Independent Director currently serves as executive director, corporate officer or employee receives payments from the Company or a subsidiary of the Company as consideration for the provision of products or services or makes such payments to the Company or a subsidiary of the Company, the amount of those transactions did not exceed 2% of the consolidated sales of either company in any one of the past three fiscal years.

(3) The Independent Director did not receive compensation (excluding compensation as a Director of the Company) exceeding 25 million yen from the Company as a legal, accounting or tax professional, or consultant (if the party receiving those assets is a corporation, association or other organization, each term above shall refer to the person belonging to that organization) in any one of the past three fiscal years.

(4) Any one of the donations, loans or debt guarantees from the Company to an organization where the Independent Director serves as an officer who executes business did not exceed 10 million yen in any one of the past three fiscal years.

(5) The Independent Director is not a major shareholder (a person who holds shares with 10% or more of the total voting rights), and does not serve as executive or full-time auditor, of the Company or a subsidiary of the Company.

(6) There are no mutual exchange of directors, corporate officers or managing Officers between the organization where the Independent Director serves in a concurrent position and the Company or a subsidiary of the Company.

(7) There are no other significant conflicts of interest between the Independent Director and the KOKUYO Group.

8. Board Effectiveness Evaluation

Since 2011, we have periodically evaluated the effectiveness of the Board of Directors (identifying issues, analyzing feedback, verifying effectiveness) to uncover issues with the way the Board of Directors currently operates and identify how it should be improved. Outlined below is the evaluation process undertaken in FY2024 along with the results of the evaluation. Guided by these results, we are taking further measures to increase board effectiveness.

【Evaluation process】

1 Interviews about board effectiveness by third-party interviewers

Interviewees: All directors

Interview period: October and November 2024

Interviewer: A third party

Interview items: Supervision of corporate strategy, supervision of the management, dialogue with and disclosures to stakeholders

2 Questionnaire survey

Respondents: All directors

Survey period: January 2025

Survey items: Items rating the running of the board, communications from the board secretariat, and level of support, each rated on a three-point

scale, along with a space for free, descriptive comments.

3 Board review meetings

Attendees: Non-executive directors

When held: Immediately after a monthly board meeting

Meeting agenda: The proceedings of the board meeting on that day

4 Discussion and summary at semiannual board meetings

Attendees: All directors

Meeting agenda: Progress made in key board themes for FY2024, board effectiveness

When held: October 2024, February 2025

Summary of overall evaluation in FY2024

The FY2024 evaluation found that the board generally satisfied the effectiveness criteria. Board discussions were robust and animated, leading to greater coherence in the strategies, plans, and actions related to the long-term vision, CCC 2030. Members gained greater clarity in how the management and supervision side should work together in furthering the company’s vision and how the management should be supervised.

However, the evaluation also suggested that the long-term vision could be implemented more effectively if the board allowed further discussion on medium- and long-term strategic priorities such as growth strategies, talent development, and risk management enhancement.

9. Policy for Determining Compensation for Directors and Executive Corporate Officers

Kokuyo’s system of compensation for corporate officers is designed to be transparent, reasonable, and concise so that the corporate officers will fulfill their duty to be accountable to shareholders and other stakeholders and contribute toward the creation of medium- to long-term value, not just short-term success. Outlined below is the company’s policy on remunerating its corporate officers along with the amounts of compensation for individual corporate officers, as set by the Compensation Committee.

Basic Policy

- The system is to enable Kokuyo to attract and retain the talent necessary to drive sustainable corporate development.

- The system is to be transparent, reasonable, and concise so that the corporate officers will fulfill their duty to be accountable to shareholders and other stakeholders.

- Compensation is to be commensurate with the recipient’s roles and responsibilities and consistent with market rates.

Criteria for determining the amount, or the formula for calculating the amount, to be paid to each recipient

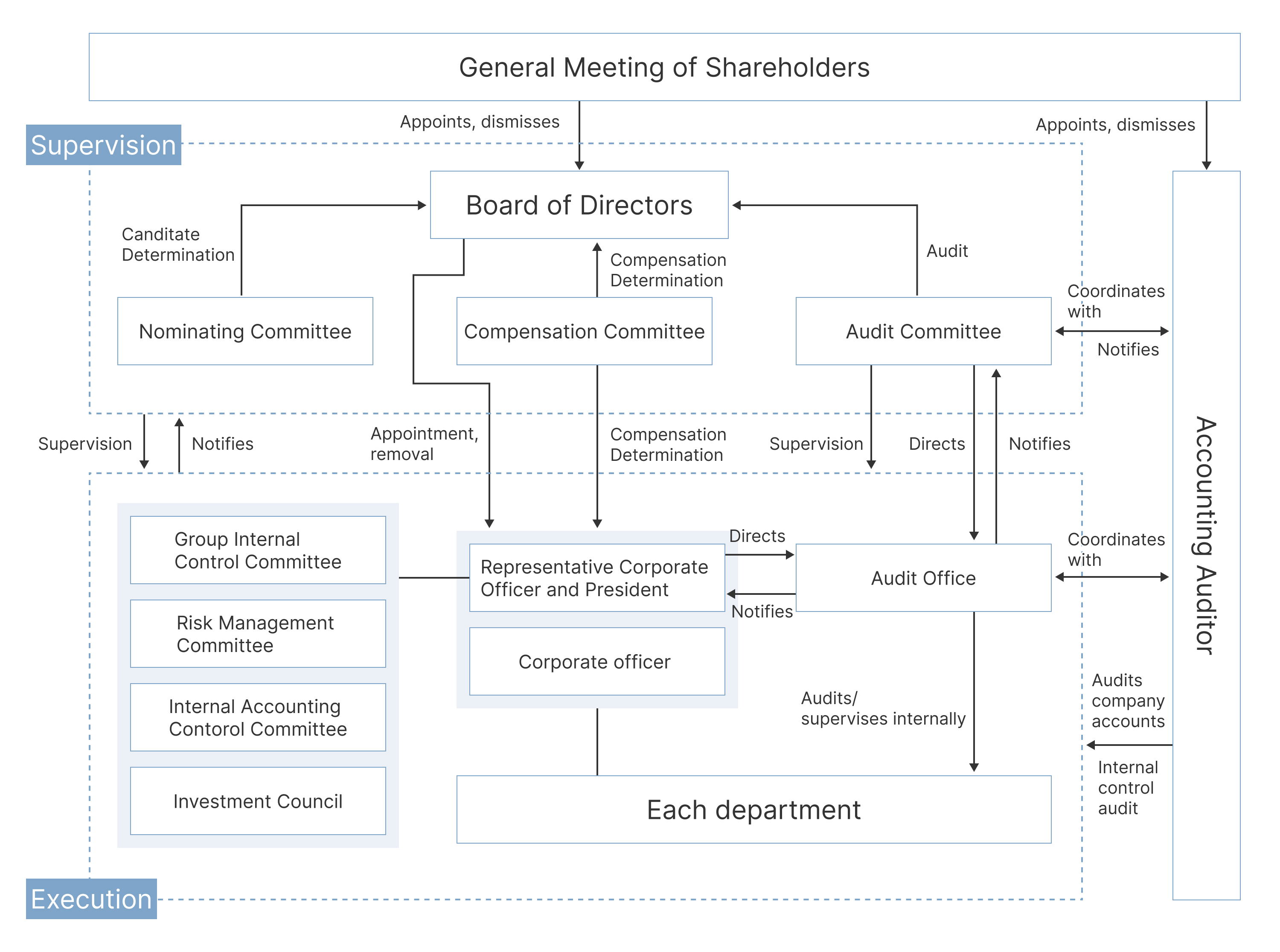

1 Compensation for executive corporate officers (who may also be serving as directors)

1.1 Approach to setting the amounts of compensation

Compensation for executive corporate officers has three components intended to remunerate the recipients for executing the company’s business.

・ Basic salary: A fixed monthly salary

・ Short-term incentive compensation: A variable amount linked with the company’s annual performance in financial and non-financial metrics

・ Long-term incentive compensation : Restricted stock compensation as an incentive for identifying with the interests of shareholders and

committing to improving the company’s value and share price over the medium and long term.

There are five compensation ranks for executive officers (reflecting the level of responsibility) and three grades of compensation per rank.

Each compensation grade has separate reference values for basic salary, short-term incentive compensation, and long-term incentive compensation. The Compensation Committee decides on these reference values after reviewing external survey data on the levels of compensation that comparable companies pay to their executives (using benchmarks such as companies in the same industry or companies of a similar scale).

1.2 Amount of compensation in each component (basic salary, short-term incentive compensation, long-term incentive compensation)

The higher the officer rank is, the higher the share of the variable components is in the total executive compensation paid. The following table shows the relative share of each compensation component at time of standardization.

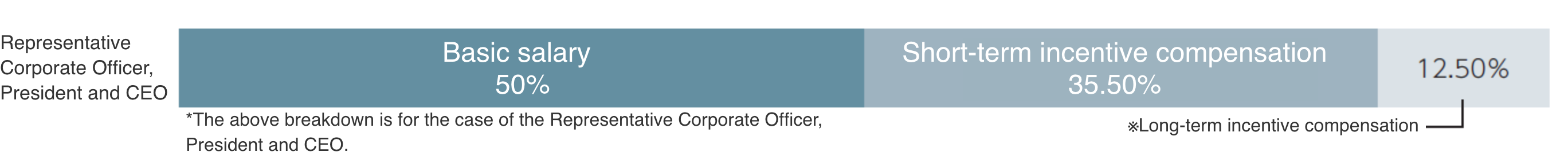

1.3 Criteria for determining the amount, or the formula for calculating the amount, of short-term and long-term incentive compensation

1.3.1 Short-term incentive compensation

- Short-term incentive compensation is calculated using organization-wide metrics, business-specific financial metrics, and non-financial metrics.

- The Compensation Committee considers and decides the following matters: what the financial and non-financial metrics are, how to calculate the share of total compensation related to these metrics, and how much weight these metrics have in each compensation rank.

- The period for evaluating results is the same as the accounting year, namely from January to December.

1.3.2 Long-term incentive compensation

The level of restricted stock compensation paid is commensurate with compensation grade.

2 Director compensation

2.1 Approach to setting the amounts of compensation

Director compensation is designed to remunerate recipients for taking important business decisions and supervising the execution of the company’s

business. It also takes into account whether the recipient serves part time or full time and the recipients’ participation in committee meetings.

The compensation system is as follows.

・Basic salary and fees for committee attendance: A fixed monthly salary

・Stock compensation: Restricted stock compensation as an incentive for committing further to improving the company’s share price (this component makes up no more than 10% of total director compensation)

2.2 Amount of compensation

The amounts of basic salary and fees for committee attendance are derived from external survey data on the levels of compensation that comparable companies (benchmarks such as companies in the same industry or companies of a similar scale) pay to their directors. These are examined and resolved by the Compensation Committee. The Compensation Committee decides on the amounts of basic salary and fees for committee attendance after reviewing external survey data on the levels of compensation that comparable companies pay to their executives (using benchmarks such as companies in the same industry or companies with benchmarks of a similar scale).

Restricted stock compensation

When issuing or disposing of the restricted stock, the company signs a restricted stock agreement with the recipients.

1 Method of allotment

The company delivers restricted stock (shares of company stock that are non-transferable until certain conditions are met) to eligible recipients with the approval of the Board of Directors. The pay-in amount per share is determined by the Board of Directors. To ensure that this amount is never such that it unreasonably benefits the recipient who is to receive the restricted stock, the board decides an amount that is consistent with the closing price of the company’s common stock on the TSE on the business day before the board makes its decision (or the nearest trading day if no transaction was made on the TSE on that day).

2 Criteria for determining the amount

For independent outside directors, the amount of restricted stock allotted is commensurate with their basic salary. For inside non-executive directors and executive officers, it is commensurate with the set level of stock compensation for the recipient’s compensation rank. For directors who are executive corporate officers, it is also commensurate with the set level of long-term incentive compensation for the recipient’s compensation grade.

When the compensation is paid and the conditions for payment

- Cash compensation for directors and executive corporate officers is paid in 12 monthly installments.

- However, short-term incentive compensation for directors and executive corporate officers is paid all at once in April.

- Stock-based compensation and long-term incentive compensation for directors and executive corporate officers is generally paid all at once in April.

10. Amounts of Compensation for Corporate Officers

Amounts of officer compensation in FY2024| Officer category | Total compensation (million yen) |

Compensation by category (million yen) | Number of recipients | |||

|---|---|---|---|---|---|---|

| Monetary | Non-monetary | |||||

| Basic salary | Short-term incentive compensation (performance-linked) |

Long-term incentive compensation |

Stock compensation |

|||

| Inside director | 46 | 43 | - | - | 2 | 2 |

| Inside Audit & Supervisory Committee member |

9 | 9 | - | - | - | 1 |

| Managing Officer | 142 | 61 | 64 | 17 | - | 2 |

| Independent Outside Director |

80 | 75 | - | - | 5 | 6 |

| Outside Audit & Supervisory Board Member |

7 | 7 | - | - | - | 2 |

11. Policy on Cross-Shareholding

In order to sustainably improve its corporate value, we have the following policy: While we generally avoid entering into cross-shareholding arrangements and have committed to reducing our cross-held shares, we will retain the such shares if they continue to offer strategic value (for example, if they help foster beneficial business relationships).

12. List of Officers

-

Takehiro Kamigama

Independent Director

Chairperson of the Board of Directors

Nominating Committee Member -

Shinichiro Omori

Independent Director

Compensation Committee Chair -

Riku Sugie

Independent Director

Nominating Committee Chair

Compensation Committee Member -

Yoko Toyoshi

Independent Director

Nominating Committee Member

Audit Committee Member -

Yuko Gomi

Independent Director

Audit Committee Member

Compensation Committee Member -

Katsuaki Tojo

Director

Audit Committee Chair -

Hidekuni Kuroda

Director

Representative Corporate Officer, President and CEO -

Toshio Naito

Director

Corporate Officer

Managing Officer of the Corporate Planning Division

13. Skills Matrix

| Name | Fields of Knowledge and Experience | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate Management | Strategies | Global Business | Digital Transformation, IT | ESG | Risk Management | Financial Affairs and Accounting | Legal Affairs | ||

| Takehiro Kamigama | ● | ● | ● | ||||||

| Shinichiro Omori | ● | ● | ● | ||||||

| Riku Sugie | ● | ● | ● | ||||||

| Yoko Toyoshi | ● | ● | ● | ||||||

| Yuko Gomi | ● | ● | ● | ||||||

| Katsuaki Tojo | ● | ● | ● | ||||||

| Hidekuni Kuroda | ● | ● | ● | ||||||

| Toshio Naito | ● | ● | |||||||